529 Rollover To Roth Ira 2025 - How Does a 529 to Roth IRA Rollover Work?, • the 529 to roth ira rollover is subject to the annual roth contribution limit, which is $7,000 as of 2025, and a lifetime limit of $35,000. 10 reasons to save for retirement in a roth ira. Understanding 529 PlantoRoth IRA Rollovers in 2025, Can you roll over a 529 to a roth ira?. The rollover from the 529 plan to the roth ira is a nontaxable transaction.

How Does a 529 to Roth IRA Rollover Work?, • the 529 to roth ira rollover is subject to the annual roth contribution limit, which is $7,000 as of 2025, and a lifetime limit of $35,000. 10 reasons to save for retirement in a roth ira.

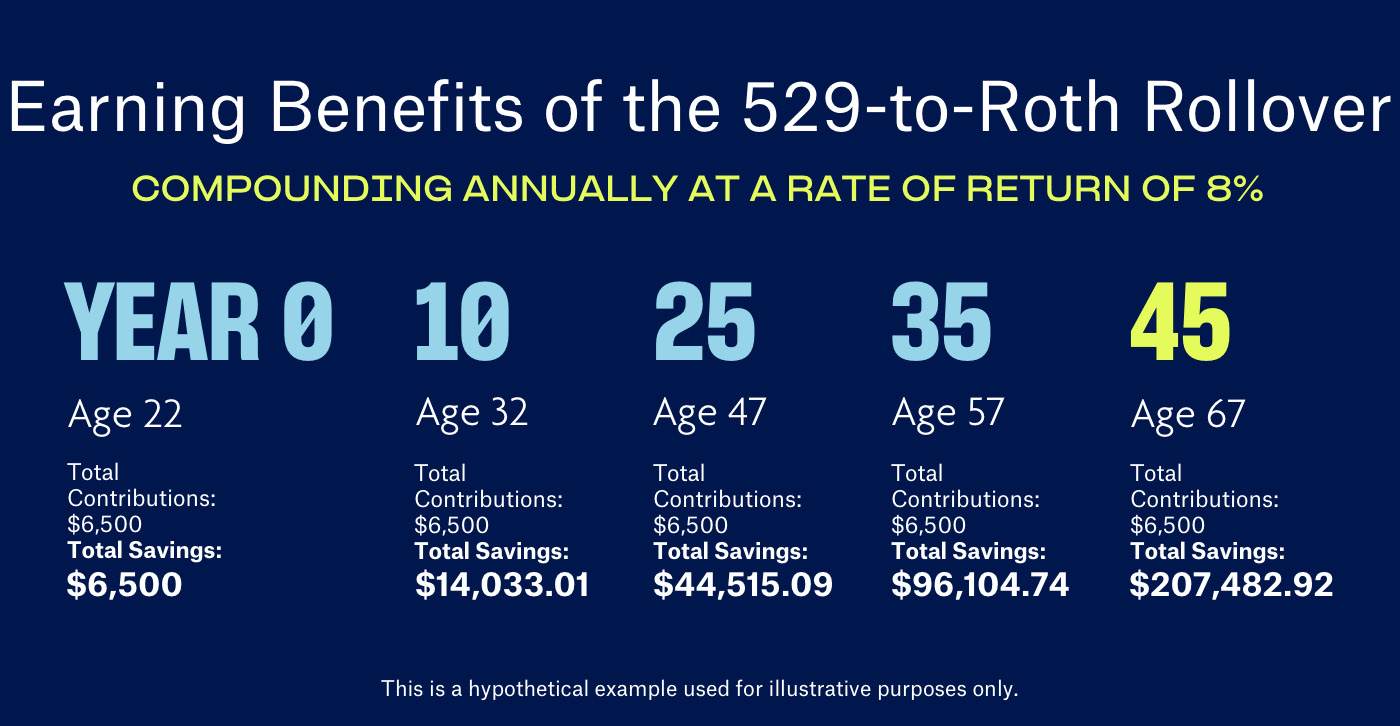

Up to $35,000 left in a 529 plan can be rolled over to a roth individual retirement account (ira) for the beneficiary.

529 to Roth IRA Rollovers—What You Need to Know Heritage Financial, This provision takes effect in 2025, not 2025. Under the new law, beginning in 2025, you can withdraw funds from an existing 529 plan and roll them into a roth ira.

Can you roll over a 529 to a roth ira?. This means if you want to roll.

529 Plan vs. Roth IRA The Best College Savings Plan EveryBuckCounts, 10 reasons to save for retirement in a roth ira. This provision takes effect in 2025, not 2025.

Coming In 2025 New 529 PlanToRoth IRA Rollover Option, Federal law now allows account owners to roll assets from a 529 plan into a roth ira. Lawmakers say new rules would rescue funds from tax penalties and promote more college savings.

NEW FOR 2025 ROLLOVER 529 INTO ROTH IRA Finance Throttle, Federal law now allows account owners to roll assets from a 529 plan into a roth ira. 10 reasons to save for retirement in a roth ira.

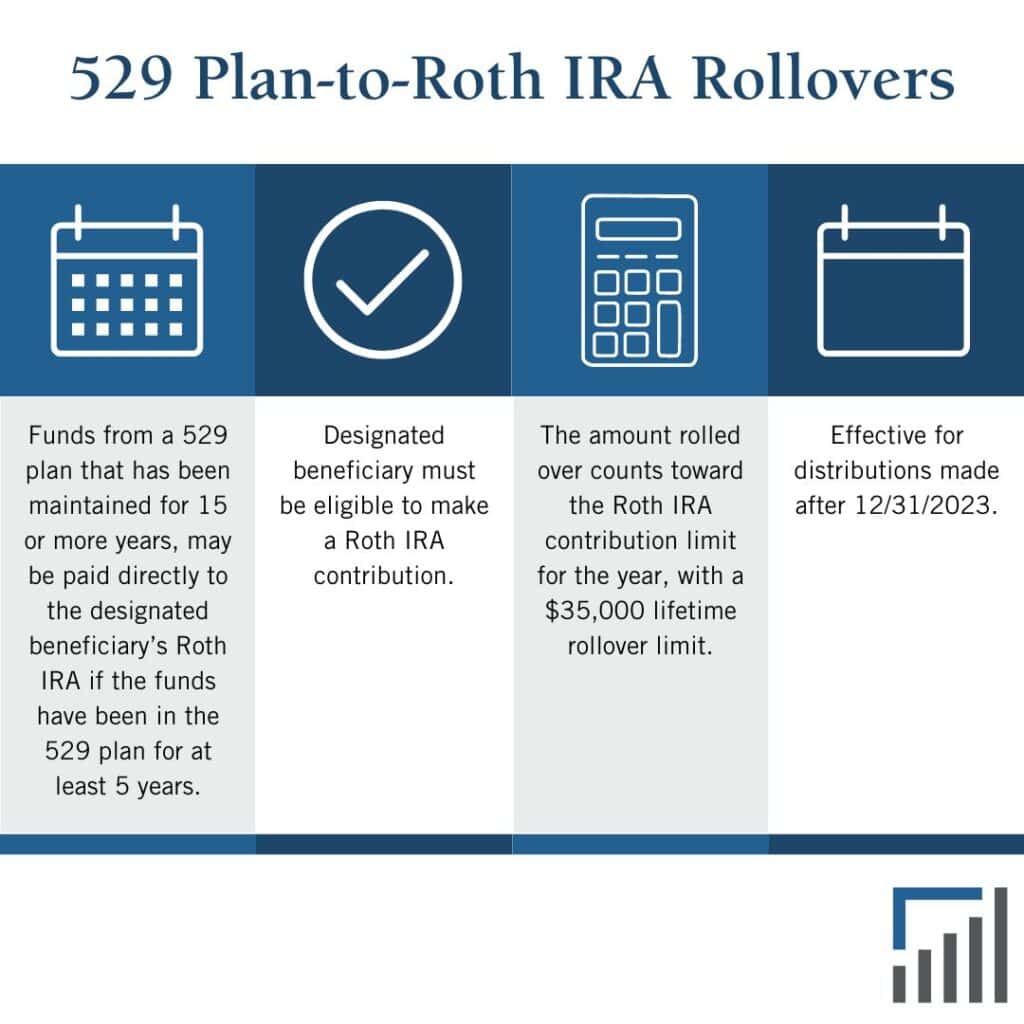

529 Rollover to Roth IRA, Starting in 2025, the new provision allows up to a lifetime total of $35,000 to be rolled over from a 529 plan to a roth ira established in the name of the beneficiary. What are the limitations on 529 plan rollovers?

Introducing the 529toRoth rollover TIAA, This means if you want to roll. The secure 2.0 act, which became law in december 2022, makes it potentially more attractive to make a 529 to roth ira conversion starting in 2025.

New 529 Plan to Roth IRA Rollover A Powerful New SECURE Act 2.0, Up to $35,000 left in a 529 plan can be rolled over to a roth individual retirement account (ira) for the beneficiary. This provision takes effect in 2025, not 2025.

The rollover from the 529 plan to the roth ira is a nontaxable transaction.

529 Rollover To Roth Ira 2025. If you have a 529 plan, or are considering opening one, you’ll likely be interested in a rule that went into effect on january 1, 2025, as part of the secure 2.0. The rollovers are subject to annual roth ira contribution limits,.

Roth IRA Rollovers from 529 Plans Could Be Permitted in 2025, The rollovers are subject to annual roth ira contribution limits,. The 529 plan must be open for at least 15.

Starting in 2025, you can roll unused 529 assets—up to a lifetime limit of $35,000—into the account beneficiary’s roth ira, without incurring the.

Starting in 2025, there is one more escape valve to a 529—the 529 to roth ira rollover.